As a frequent climber at various London gyms, I figured it was about time to write an article about the mega-expansion of the industry in the city that first introduced me to the sport.

With new streams of financial capital1 and overseas investors entering the market2, climbing has entered a new phase, characterised by expansion and the displacement of less productive gyms.

In this article, I take a look at the recent history of climbing in the capital, the types of gyms being set up and the competitive forces that are emerging.

A brief history…

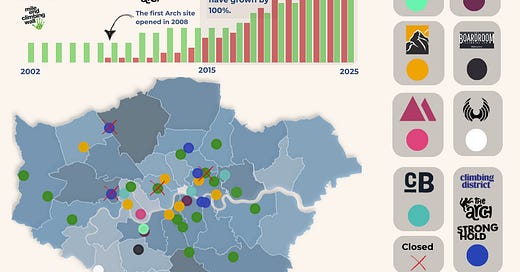

When I first started climbing around 2015, there were 12 gyms in London. These included The Castle, The Westway, The Reach, The Arch, Mile End Climbing Wall and VauxWall. At the time, it was reasonable to assume gyms could attract and retain customers largely based on being geographically isolated from the competition—a concept economists capture with the Hotelling Model.

As I was living and studying north of the river, it was rare for me to venture outside of my 15 or so minute commute to The Castle. Meanwhile, my friends south of the river were heavily invested in Bermondsey’s Arch site or LCC’s VauxWall West. It goes without saying that these friends became strong boulderers, whilst I became more adept with a rope.

As the popularity of climbing picked up in the late 2010s, economic forces dictated that supply keep up. In fact, between 2015 and 2020, we saw the establishment of 13 new gyms, over half of these being the expansion of chains.

Despite a dip in nationwide climbing participation during the Covid years, we didn’t see a large number of gyms closing down. In contrast, we have continued to see new walls (10 walls, to be precise) opening their doors over the past 5 years.

Currently there are 35 gyms in London, of which roughly 60% are chain-sites (LCC, The Arch, The Climbing Hangar…). 76% of these gyms are bouldering-only. The Castle, Mile End Climbing Wall and the Westway, established in the 80s and 90s, still hold dominant positions when it comes to rope climbing.

Is it all Bouldering?

In short, yes. Of the 23 new arrivals over the past 10 years, only Parthian’s Wandsworth site offers rope climbing3.

Bouldering is more accessible for new climbers (there’s no need to pass a belay assessment) and the spaces have fewer requirements (a much lower minimum height, for example). Instructors and route setters also require fewer qualifications.

This is not to say that rope climbing is dead: according to the BMC Your Climbing Counts survey4, nearly two-thirds of climbers rope climb at least once per month. However, in my experience, these are less likely to be the beginner climbers who have driven the growth in popularity5.

The competition is heating up

With 35 gyms all wanting a slice of the pie, quality of service and price strategies have become much more important. Economic theory generally says that greater competition among suppliers is good for consumers. Suppliers must offer competitive prices and offer a more valuable product to continue to attract customers.

In climbing, this means better training areas and boards, higher-quality route setting, food options, coaching, friendlier vibes… The list is endless, and it is down to gyms to understand (1) what current customers value, and (2) the demands of the marginal customer (that person who still isn't sure whether they want to commit). These two are often not the same, and we are already seeing different styles of gyms emerging to meet these varying demands.

The majority of gyms adopt a median approach, with most routes ranging from beginner - to attract new climbers - to intermediate, satisfying the more experienced climbers as well as providing realistic progression for beginners.

However, we have recently seen the emergence of niche Japanese-style training gyms, such as Muro in Peckham, which are targeted towards the more advanced climber. Blocfit, which opened in 2018, has a similar approach.

We are yet to see if this strategy proves successful in this new phase of the industry, but it does suggest a shift towards more segmented offerings that cater to specific skill levels and training goals, rather than aiming for broad mass-market appeal.

I heard that a French company took over some gyms?

Customers of The Arch and Stronghold gyms will be aware that they are now customers of Climbing District, a dominant force in the Parisian climbing scene.

This is significant, and shows that getting a foot into the London market is crucial when it come to becoming an established European player. With significant capital at its disposal, we may see Climbing District use these initial acquisitions as a stepping stone into the broader UK market. Discussing with Euro Climbing News, Climbing District aims to streamline the customer experience, as well as reestablish a style of climbing that emphasizes movement progression over crowd-pleasing ‘jug ladders’.

Moves like this, as well as market consolidation among UK gyms (such as LCC’s acquisition of Big Rock in Milton Keynes and Rainbow Rocket in Cambridge) may lead to a better climbing experience for staff and customers alike - improved wages and contracts, more standardized route setting and higher quality holds.

Conclusion

The main concern among those that have been in the industry for many years is that the gradual commercialization of the sport will destroy the culture and values that the purists hold so close. In reality, the definition of a climber has changed, as has the culture surrounding it, and the facilities gyms provide must reflect that.

That said, The Climbing Hangar’s CEO Ged MacDomhnaill warns in this interview that allowing the sport to become a soulless commodity will lead to its downfall6. In my opinion, it is in large part the responsibility of these big chains to prevent that from happening.

See Verlinvest’s backing of The Climbing Hangar.

In 2025, London’s Arch and Stronghold gyms were acquired by French firm Climbing District.

West 1 also offered rope climbing, but sadly closed its doors in 2024.

https://thebmc.co.uk/en/your-climbing-counts

Note that the vast majority of people that participated in this survey had been climbing for more than 3 years.

I recently heard someone use “the ‘McDonalds-ization’ of climbing”. It’s now part of my internal dictionary.